Assessment Year 2018-2019 Chargeable Income. 20182019 Malaysian Tax Booklet Personal Income Tax.

B40 M40 T20 The New Figures In 2020 Trp

Income Tax Rates and Thresholds Annual.

. Harga Pelupusan Dianggap Bersamaan Dengan Harga Pemerolehan Available in Malay Language Only Transfer Of Asset Inherited From Deceased Estate. Disabled individual 6000 5. Non-resident individuals pay tax at a flat rate of 30 with effect from YA 2020.

A non-resident individual is taxed at a flat rate of 30 on total taxable income. Self Dependent 9000 2. Assessment Year 2019 Individual Taxable Income for the first RM35000 is RM900 and calculate on 10 for the next RM15000 of total income.

The deadline for filing income tax in Malaysia is April 30 2019 for manual filing and May 15 2019 via e-Filing. Introduction Individual Income Tax. Tax Rates for Individual Assessment Year 2019.

Malaysia Personal Income Tax Rate A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum of 30 on chargeable income exceeding RM2000000 with effect from YA 2020. Malaysia Residents Income Tax Tables in 2019. View Malaysia Personal Income Tax Guide For 2019docx from BUSINESS 4303 at College of Banking and Finance.

Internet Explorer 110 Microsoft Edge Mozilla Firefox 440 Google Chrome 460 atau Safari 5. 11 rows Malaysia Residents Income Tax Tables in 2019. Dimaklumkan bahawa pembayar cukai yang pertama kali.

You can file your taxes on ezHASiL on the Inland Revenue Board of Malaysia IRB website. If you have no clue what the answers for these questions are. Calculations RM Rate TaxRM 0 - 5000.

Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any information obtained from this website. Read our comprehensive tax guides for info and savings tips before your next visit to LHDN e-filling. And speaking of that any income that you earn outside of Malaysia is not taxable.

On the First 5000. Income Tax Rates and Thresholds Annual. Imposition Of Penalties And Increases Of Tax.

Responsibility Of Disposer And Acquirer. It should be noted that this takes into account all your income and not only your salary from work. Best Income Tax calculator in Malaysia.

Assessment Of Real Property Gain Tax. Start e-filing for personal income in 2017 with our easy-to-use calculator to find out your tax deductions relief and total rebates. Malaysias 2019 Budget will see an increase in stamp duties to 4 from 3 for transfer of real properties that are RM1 million and higher.

Malaysia personal income tax guide 2019 YA 2018 242019 62800 AM KUALA LUMPUR April 2 Income tax season is here in Malaysia so. There will be a two-year stamp duty exemption for the first RM300000 for houses priced up to RM500000. Microsoft Windows 81 service pack terkini Linux atau Macintosh.

Pengesahan ini boleh didapati melalui perkhidmatan ezHASiL di httpsezhasilgovmy atau di cawangan-cawangan LHDNM. Personal Income Tax 20182019 Malaysian Tax Booklet 23 An approved individual under the Returning Expert Programme who is a resident is taxed at the rate of 15 on income in respect of having or exercising employment with a person in Malaysia for 5 consecutive YAs. This translates to roughly RM2833 per month after EPF deductions or about RM3000 net.

Malaysia Personal Income Tax Guide For 2019 Have you filed your income tax. Individual Life Cycle. Registering as a first-time taxpayer on e-Daftar Before you can file your taxes online there are two things youll need to do first.

Basic supporting equipment for disabled self spouse child or parent 6000 limited 4. Any individual earning a minimum of RM34000 after EPF deductions must register a tax file. 13 rows 28.

Medical Expenses for Parents OR Parent Limited 1500 for only one mother Limited 1500 for only one father 5000 limited OR 3000 limited 3. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a qualified activity in that specified region. Cancellation Of Disposal Sales Transaction.

Types of Contribution allowed for Personal Tax Relief Individual Relief Types Amount RM 1. You can calculate your taxes based on the formula above and just make sure your total income in the first column comes up to. At this juncture its worth mentioning that theres a difference between filing your tax returns and paying taxes as not everyone who files their returns will need to pay taxonly those who earn RM34000 and more a year.

2017 Personal Tax Incentives Relief For Expatriate In Malaysia

Asia Pacific Sovereign Rating Trends 2022 New Covid Strain Thwarts An Earlier Recovery S P Global Ratings

Malaysia Personal Tax Relief Ya 2019 Cheng Co Group

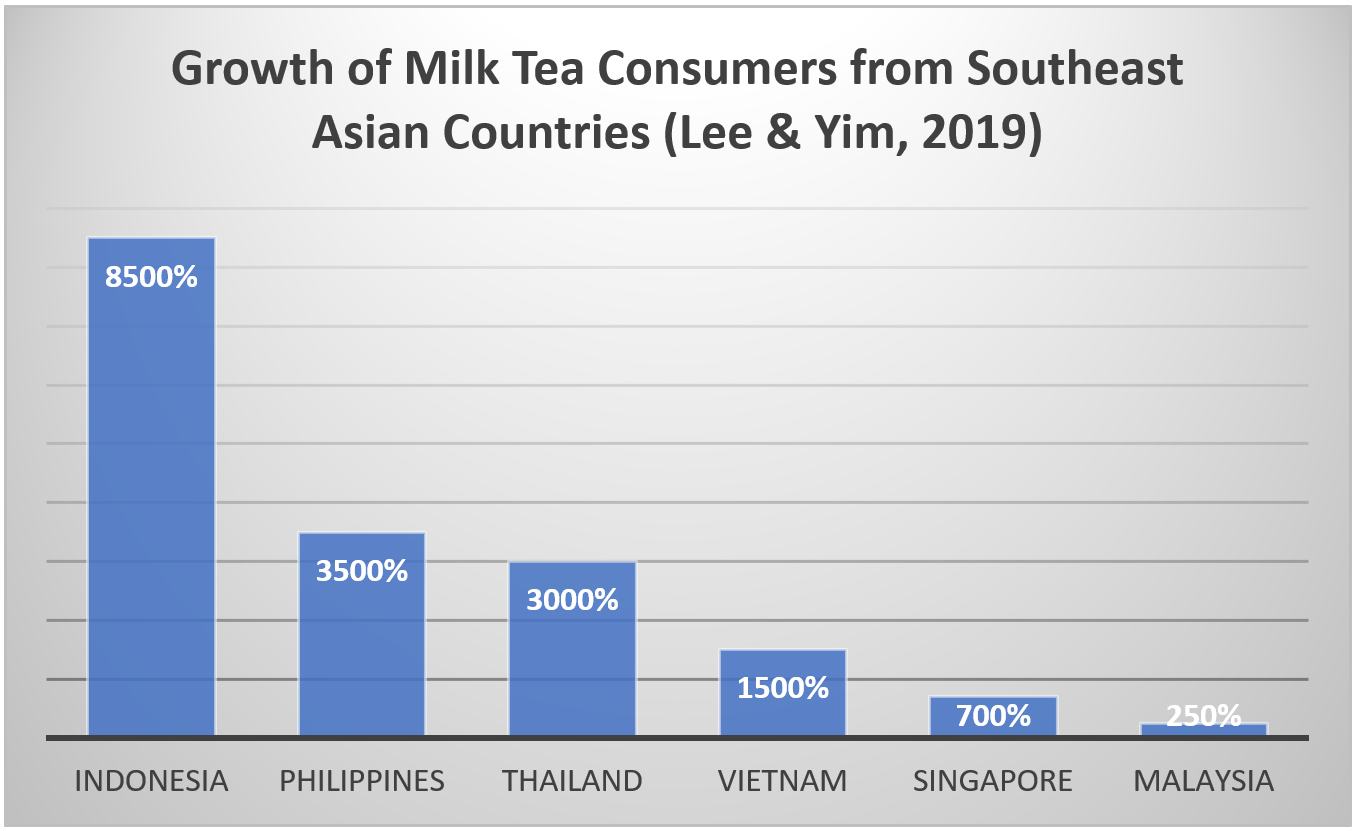

Foods Free Full Text Consumer Preference Analysis On Attributes Of Milk Tea A Conjoint Analysis Approach Html

Malaysia Gdp Per Capita Ppp Data Chart Theglobaleconomy Com

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Latest News Chartered Accountant Latest News Accounting

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

T20 M40 And B40 Income Classifications In Malaysia

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

Malaysia Maxis Bhd S Total Revenue 2021 Statista

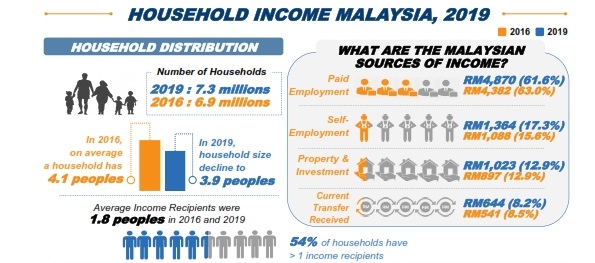

Special Report Gleaning Insights From The 2019 Household Income Survey The Edge Markets

2022 年大马报税需知 纳税人税率 Kadar Cukai 及如何计算税金 Map Screenshot Map Periodic Table

2021 28 Vietnam S Solar Power Boom Policy Implications For Other Asean Member States By Thang Nam Do And Paul J Burke Iseas Yusof Ishak Institute

Lhdn Irb Personal Income Tax Relief 2020